If you’re starting an ecommerce business, you want a software application that will allow you to set up your store and manage day-to-day operations—at a reasonable price, of course. With a variety of ecommerce platforms on the market, all at different price points, you may be wondering if there are any free options. That’s where open source platforms, like PrestaShop, come in. Unlike many other ecommerce solutions, open source platforms are free to download and allow you to modify the code of the software to fit your specific needs.

The PrestaShop open source platform was created in 2005 and has grown substantially since. Now one of the most popular ecommerce platforms in Europe, PrestaShop is known for their free software, customizability, and international reach. Is PrestaShop the right fit for your small business? In this PrestaShop review, we’ll help you answer that question by taking a look at PrestaShop’s features, pricing, customer reviews, and comparing their platform to industry competitors.

PrestaShop: The Basics

PrestaShop is a European-based ecommerce software platform. Up until 2018, PrestaShop only offered their free open source ecommerce solution, which as we mentioned above, allows you to download and install the software and customize it for your particular business. In late 2018, however, PrestaShop launched a fully hosted, ready-to-use version of their platform called PrestaShop Ready.

Whereas PrestaShop’s original offering is open source and free to download, PrestaShop Ready runs on a subscription basis. Just as with other platforms like Shopify and BigCommerce, everything you need to run your store is part of PrestaShop Ready—essentially, PrestaShop Ready removes the development and technical resources that are needed for their open source platform.

Additionally, with PrestaShop Ready, web hosting is included as part of the platform and your store is hosted through Google Cloud. For the open source version of PrestaShop, you need to find your own web hosting or work with PrestaShop’s hosting partner, 1&1 IONOS.

Both of the PrestaShop ecommerce offerings, however, give you the fundamental ability to set up and launch your online store. You can customize your website, add products, manage your orders, process payments, market your store, and support your customers.

PrestaShop Features

Although PrestaShop has two different ecommerce platform options, the features included with each are mostly the same. According to their website, PrestaShop has over 600 features, fulfilling your full range of ecommerce business needs—store management to shipping to marketing, and more.

Store Creation

PrestaShop allows you to create your store’s website and customize it to your business. If you’re using PrestaShop open source, you can either use and customize the default template or buy and download others from PrestaShop Addons, their official add-on marketplace. PrestaShop Ready, on the other hand, requires that you choose one of the handful of customizable templates included within the platform. With PrestaShop Ready, you also have access to a blog for your store.

For both options, however, you can organize your products, configure internal search, adjust the navigation, and dictate your checkout process, including one page checkout. In addition, you can optimize your store for international business. PrestaShop includes translation for over 25 different languages and allows you to use a multi-language product sheet to adapt to different markets. You can also set the currencies you accept and automate the exchange rate movements.

Payment Processing

One of the biggest differences between PrestaShop open source and PrestaShop Ready are the payment processing options. PrestaShop Ready allows you to accept payments four ways: Stripe, PayPal, bank transfers, and checks. Using Stripe or PayPal as your processor, you can accept credit card payments.

For PrestaShop open source, on the other hand, you have significantly more options. You can work with one of the PrestaShop Partners (free or paid), which include payment processors like PayPal, Braintree, Amazon Pay, WorldPay, Authorize.Net, and more. You also have the option to pay for and download one of the other 250+ payment add-ons from the PrestaShop marketplace.

Product and Customer Management

With the PrestaShop ecommerce platform, you can list an unlimited number of products on your site. You can give features and values to your products, create packs, sell customizable goods, as well as add and sell digital products. You can also create both product categories and subcategories, track your inventory, and get a dashboard overview of your manufacturers and suppliers.

For your customers, you can allow them to create an account and track their orders. Through your PrestaShop interface, you can create a customer information database, as well as run customer service activities.

Order Management and Shipping

You can create and edit orders from your PrestaShop admin, customize a workflow for orders and returns, print shipping slips, as well as automate email templates for different order status. PrestaShop also allows you to configure shipping with your chosen carrier, choose delivery zones, determine the pricing for different shipping methods, and calculate taxes based on location. Users of PrestaShop Ready receive a special offer, 100 euros free ($112.16 as of April 2019), from PrestaShop Partner Upela, which includes local and international shipping carriers.

Marketing and Reporting

PrestaShop includes integrated marketing and reporting capabilities. You can create special offers, highlight your products, and increase engagement through abandoned cart, recently viewed, and back-in-stock product emails. PrestaShop lets you manage your store’s SEO, connect to social media pages, and run digital advertising on your site. The reporting functionality allows you to track marketing, sales, customer, and product performance—as well as provides an overview of your main data.

Add-Ons

Another one of the main differences between PrestaShop Ready and PrestaShop open source is the access to add-ons. You can only download and buy add-ons from the PrestaShop marketplace if you are using the open source version of PrestaShop. This marketplace offers over 6,000 modules, themes, and services—ranging from site navigation tools to social media integrations to shipping services. These add-ons are not currently available to PrestaShop Ready users.

PrestaShop Support

The last real difference in terms of features for PrestaShop Ready vs. PrestaShop open source is the support for their users. A PrestaShop Ready subscription includes 7/7 support (seven hours a day, seven days a week) from PrestaShop customer support, as well as tips and tutorials within the platform. Dedicated support is not included with the open source option, however, PrestaShop does offer different support plans for open source at additional costs.

For both platforms, you also have access to useful resources like the PrestaShop forum, community, documentation, FAQs, as well as YouTube tutorials.

PrestaShop Pricing

After going through the full range of features that PrestaShop offers, you may find yourself asking, “Is PrestaShop really free?” This is a valid question, and the answer, unfortunately, requires more than a simple “yes” or “no.”

To explain, PrestaShop’s traditional ecommerce platform offering is open source, so yes, it’s free to download (they also offer a free demo). However, although the actual open source software is free to download, this doesn’t mean that it will be totally free to run your ecommerce business through this platform.

If you use PrestaShop’s open source software, you’ll have to find your own web hosting, which comes at a cost. Using PrestaShop’s hosting partner, for example, will cost you anywhere from $8 per month to $14 per month, depending on which plan you choose. Other hosting providers may have different rates. Additionally, there will be the cost for payment processing, which will vary depending on the processor. Stripe, as an example, charges 2.9% + $0.30 per transaction. Some of the payment add-ons are free to download with PrestaShop, like PayPal, for example. But others, like Square, require you to pay ($169.99) to download the module itself.

Furthermore, if you want to extend the functionality of your store to more than what is included in PrestaShop, you’ll have to pay for themes and modules from the marketplace to allow you to do that. Plus, the more customization you want, the more you’ll need to work with a developer to help you build your site. This is an added cost (and potentially a big one) people often forget about when it comes to open source ecommerce platforms. Unless you have technical knowledge, platforms like PrestaShop open source typically require help from a developer to set up, and sometimes manage, your store.

Modules in the PrestaShop marketplace; photo: PrestaShop

Modules in the PrestaShop marketplace; photo: PrestaShop

Taking all of this into consideration then, PrestaShop open source is free to download; however, the cost to run your ecommerce business through it can vary depending on your business’ needs.

PrestaShop Ready, on the other hand, runs on a subscription basis. You can purchase a plan on a month-to-month basis, or annually. If you choose the annual plan, you will receive a 20% discount. As of April 2019, PrestaShop Ready only has one plan option, the Start plan—although according to the PrestaShop website, Pro and Premium are coming soon. The Start plan costs 24.90 euros per month ($27.93 as of April 2019), or 19.90 euros per month ($22.32 as of April 2019) if you do the annual plan.

PrestaShop Ready has a few additional costs besides the monthly fee as well. There is a 1.5% platform fee that kicks in after 3,000 euros ($3,364.51 as of April 2019) turnover. Furthermore, just like with PrestaShop open source there is a cost for payment processing. Unlike with the open source platform, however, you don’t have to pay for the actual module because Stripe and PayPal are included (these are your only two options though). As we mentioned above, Stripe charges 2.9% + $0.30 per transaction.

PayPal works with PrestaShop Ready at a special rate, 0.25 euros ($0.28 as of April 2019) per transaction and 1.40% of the amount cashed for six months, starting from the date of your choice. Two cost benefits, however, you receive with this platform are 100 euros ($112.16 as of April 2019) in free shipping with Upela and 75 euros ($84.12 as of April 2019) free for every 25 euros ($28.04 as of April 2019) spent with Google Adwords. PrestaShop Ready also offers a free 15-day trial of their platform, no commitment or credit card required.

Luckily, unlike with the open source platform, web hosting, themes, and user support are all included in the subscription price. Remember, however, that PrestaShop Ready does not give you the ability to download (free or paid) add-ons from the marketplace; you must work with the integrations already included in the platform.

Pros of PrestaShop

Now that we’ve broken down the features and pricing of PrestaShop, let’s take a look at some of the most beneficial aspects of the platform. Here are a few:

Features

There’s no doubt that with 600+ features, PrestaShop gives you a lot to work with when building and running your ecommerce store. From unlimited products to one page checkout to abandoned cart emails, you certainly can’t say you’re missing out if you use PrestaShop. For PrestaShop open source in particular, you have an impressive amount of capabilities, considering the software is free to download.

Additionally, if there is an ability you’re missing when you use PrestaShop open source, you can explore the 6,000 add-ons in their marketplace to increase your functionality. Also, if you choose to capitalize on the flexibility of open source, you can truly customize the software to your business, in ways you can’t with a typical ecommerce platform. If you use PrestaShop Ready, on the other hand, you still have full access to the platform’s features, plus the added bonus of web hosting, included themes, user support, and those cost deals we mentioned earlier.

Usability

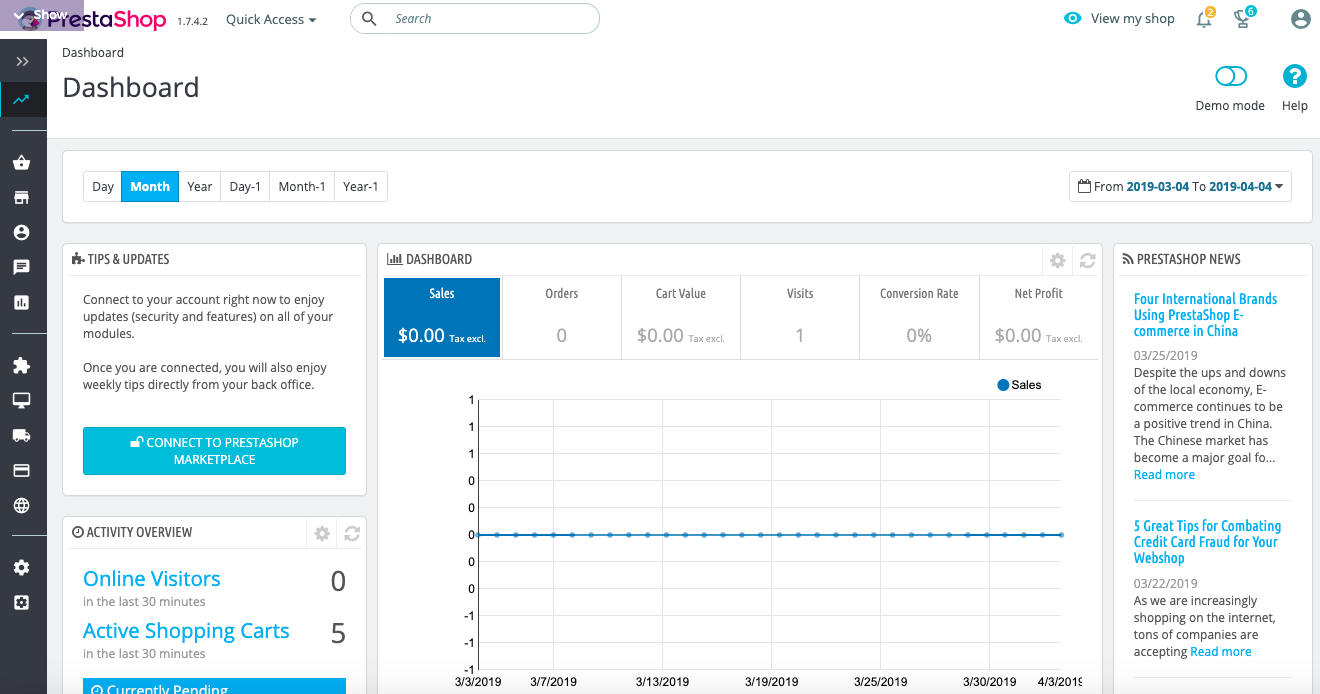

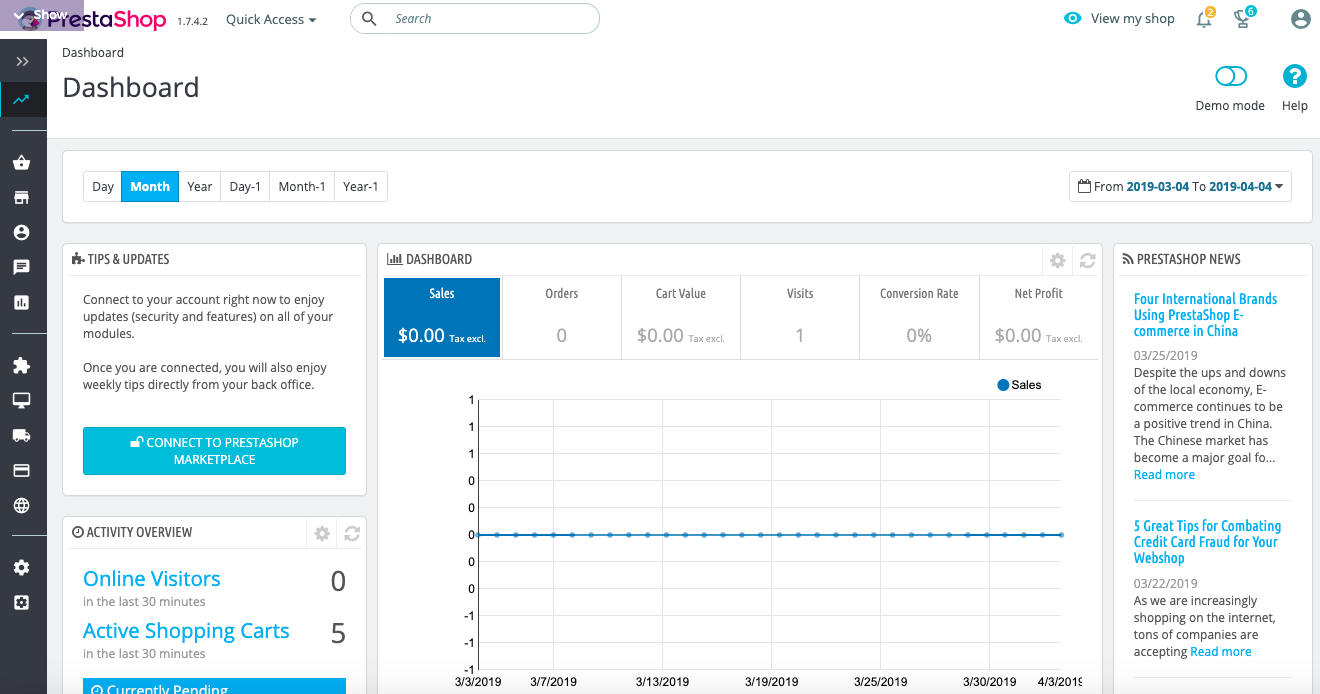

Even though PrestaShop was first and foremost an open source platform, by all accounts it seems to be user-friendly and pretty simple to use (as you can see from the free demo). The platform has incredible functionality, and yet, the dashboard is still clean and intuitive. Although you may require some developer assistance if you’re using open source, PrestaShop certainly appeals to beginner and advanced users alike, especially when compared to some other open source software like Magento.

PrestaShop free demo dashboard; photo: PrestaShop

PrestaShop free demo dashboard; photo: PrestaShop

International Reach

Probably one of the most unique qualities about PrestaShop is the international reach their platform offers. Based in Europe, PrestaShop has ensured that their users’ businesses can function across the continent—and beyond. In fact, out of their almost 250,000 live sites, over 30% of those sites are U.S. based. Since you can present your store in several different languages and currencies, as well as adjust your checkout for varying taxes and shipping, PrestaShop is equipped to facilitate businesses all over the world.

What PrestaShop Customer Reviews Say

PrestaShop product reviews on the internet are generally positive, with users discussing much of what we mentioned above. Customers say that the platform is flexible, handles many different capabilities, and can be a good fit for users of varying experience. Users of the open source platform comment on the large PrestaShop developer base and community, saying that these resources are extremely helpful. Many users, in fact, compare PrestaShop to other open source offerings, like OpenCart and Magento, and say that PrestaShop is better for cost and functionality. It’s worth noting, however, that PrestaShop customer reviews as of April 2019 focus on the open source software and do not mention PrestaShop Ready.

Cons of PrestaShop

Although PrestaShop has some strong benefits, there are drawbacks to consider, as well. Here are a few cons to keep in mind:

Development

In terms of PrestaShop open source, if you don’t already have technical knowledge, it’s always going to be more difficult to run your ecommerce business through an open source platform. Although PrestaShop includes much of what you’ll need already, you still have the challenge of downloading, installing it, and figuring out the technical aspects of the software. More than likely, you’ll need development help, which can certainly be a hassle (and expense) for many business owners.

Additionally, due to the nature of open source, developments in the software are constantly being released, which means the possibility of bugs, version conflicts, and no professional support from PrestaShop to help you through them. Not to mention, although the marketplace can give you access to helpful add-ons, you have to incorporate them into your platform yourself, and risk the possibility that they don’t integrate quite right with the software and cause software issues.

Cost

The free aspect of platforms like PrestaShop open source is appealing to many owners looking for the most efficient way to run their ecommerce business. However, although open source is free to download, as we’ve explained, there are numerous additional costs to consider. These costs are unpredictable and can vary—you may end up spending more on this “free” platform than you would with a subscription-based, full-service option.

In terms of PrestaShop Ready, on the other hand, you have more upfront costs for one service option. Although this may seem beneficial, especially considering the number of included features, the platform fee in combination with the payment gateway fees, could end up making PrestaShop Ready more expensive than it appears.

What PrestaShop Customer Reviews Say

Although most PrestaShop product reviews are positive, users do mention their problems with the platform as well. The biggest con that users seem to agree upon is the development issues of open source. These PrestaShop customer reviews say that the software can be buggy and there are glitches between versions and when adding modules from the marketplace. Another common complaint is the cost of some of the add-ons and the comment that PrestaShop is not really free. Again, it should be noted that these reviews all apply only to the open source version of PrestaShop and there aren’t currently reviews discussing PrestaShop Ready.

PrestaShop Alternatives

Before deciding PrestaShop is the ecommerce platform for you, it’s worth exploring all of your options and taking a closer look at some of PrestaShop’s competitors. Here are two alternatives:

Shopify

Shopify is one of the biggest players in the ecommerce industry, and for good reason. Shopify is known for its ease of use (beginner and beyond), customizability, and integration capabilities. Shopify, like PrestaShop Ready, is a fully hosted platform. Although Shopify has many of the same features as PrestaShop Ready, it also offers different plans and pricing based on your needs, app integration possibility, and does not have a platform fee (unless you use an alternate payment processor). Shopify is a worthy alternative to PrestaShop Ready and even to PrestaShop open source if you’re concerned about development resources and cost. One customer review for PrestaShop even says if you don’t want to learn the technical aspects, choose Shopify.

Magento

If you’re looking specifically for an open source ecommerce platform, the only one that truly compares to PrestaShop is Magento. Magento is actually one of the most popular ecommerce platforms in the world and is well-known for their open source offering. Magento has an impressive feature list and gives you the ability to extend your functionality, like PrestaShop, with add-ons from their marketplace. Although much of what Magento offers is quite similar to PrestaShop, Magento focuses more on their customizability, offering a wider range of add-ons for users. Additionally, Magento appeals to businesses who are larger or growing quickly and have unique needs. Admittedly, however, Magento seems to be more costly because of the development resources required for set up and maintenance of the platform. If you’re looking to take your business to the next level in terms of customization and have the development capabilities to do so, Magento is worth considering.

Is PrestaShop Right for My Business?

Ultimately, the right ecommerce platform for you depends on your business and specific needs. If you’re particularly interested in an open source platform, PrestaShop is definitely one of the best out there. With over 600 features included in a free, downloadable software, you already have impressive functionality that you don’t get with many other platforms. Additionally, if you’re looking to run your store internationally, PrestaShop is a great choice to facilitate that business.

Like with all open source platforms, however, keep in mind that there are added costs beyond the software itself. If, on the other hand, you’re looking for a fully hosted platform, you might be better off going with a tried-and-true solution, like Shopify. Although PrestaShop Ready gives you access to a significant amount of features, other more established platforms give you similar functionalities at a similar price point, with the added bonus of plan options and integration capabilities. At the end of the day, if you’re considering either of PrestaShop’s offerings, you should take advantage of the free trial and free demo to help you reach a decision.

The post PrestaShop Review: Pricing, User Reviews, Alternatives appeared first on Fundera Ledger.

from Fundera Ledger https://www.fundera.com/blog/prestashop-review

PrestaShop Review: Pricing, User Reviews, Alternatives

first seen on http://barbarapjohnson.blogspot.com